Your Trusted Partner in Multifamily Services

National Footprint

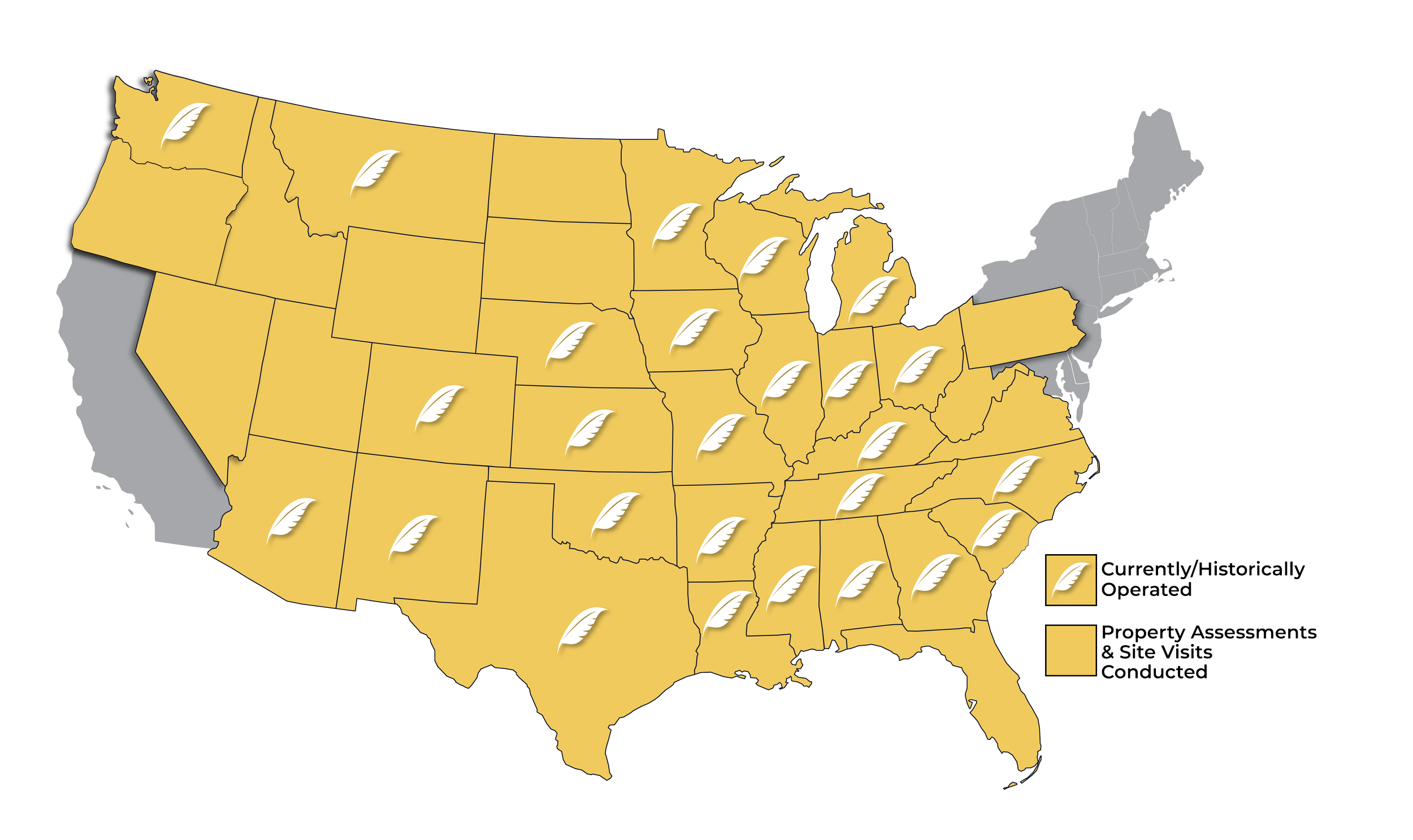

AFI has the capability to work in every state across the nation. With a presence spanning over 20 states and 75+ vibrant cities, AFI brings unmatched expertise and local knowledge to each community it serves. AFI's team has conducted financial analyses and site visits in 35 states, giving AFI an in-depth understanding of local markets and neighborhoods.

With 35+ years of industry experience, AFI is committed to leveraging its comprehensive knowledge to provide exceptional service wherever partners need it. Explore AFI's map to see where AFI can partner next!

Local Expertise

ACCOUNTABILITY

•

COLLABORATION

•

EFFICIENCY

•

INNOVATION

•

INTEGRITY

•

PERSERVERANCE

•

ACCOUNTABILITY • COLLABORATION • EFFICIENCY • INNOVATION • INTEGRITY • PERSERVERANCE •

Worked with AFI in the past?